Good Till Cancelled GTC FAQ’s

Contents

After selecting the stock, you should now click on the hamburger button in the top right corner. Yes, Customers can place GTDT Buy and Sell (sell- Open position only) order under E-Margin Product. You can view the status of your GTDt orders by visiting the order book of respective segment on trading page. You can place maximum 5 GTDt orders for a particular scrip and in all you can place maximum 30 GTDt orders across all eligible scrips.

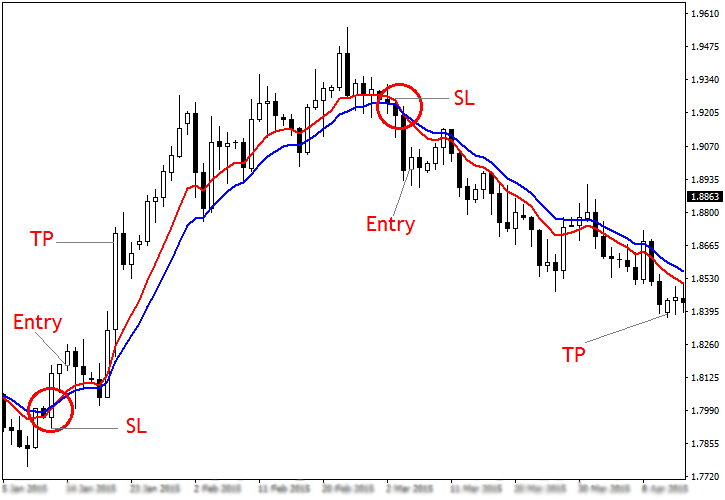

Ltd. makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Terms and conditions of the website are applicable. This product is meant for short-term traders who want to make the best use of any volatility. “Using this product one can place a ‘book profit’ and ‘stop loss order’ simultaneously. When one of the orders is executed, the reverse is cancelled,” says Vishal Gulecha.

Every new feature makes the Angel One experience faster, smoother, more powerful, and sometimes all three. On the sale side, there are three investors who have put up limit orders to sell their share they hold in the same company. There are hundreds of other investors in the market and there are high chances that at least a few investors will be placing a limit order at the same price. https://1investing.in/ For cancelling order though ITS kindly login into your trading account and visit Equity order book & Derivatives order book to cancel your GTDt orders anytime during market hours OR after market hours. You will have to ensure that necessary funds/margin are available in your allocation for HDFC sec to place GTDt orders in your account for the unexecuted quantity of the order.

- If you want to place a limit order in GTT, you can do so by clicking on the limit price button right below the trigger price.

- The days/date counted are inclusive of the day/date on which the order is placed.

- In this case you can choose the GTDt order validity date as less than or equal to June 21, 2015.

- A stop-limit order is useful when there is a range of minimum and maximum prices at which a trader is ready to buy or sell the stock.

- To cover this, the exchange also imposes Extreme Loss margins on the client.

There are a few trading sessions that are scheduled on weekends. In a stock limit order, purchase orders are executed chronologically. In our example, there are only 30 shares on sale and the cumulative demand is for 50 shares. The purchase orders will then be executed on the basis of who placed the order first. In our example, investor A will get his 10 shares, investor B will get his 20 shares. C and D’s orders will get canceled for that particular day because the number of shares on offer for sale were all purchased till the time C and D’s orders were reached.

Easily modify/ cancel entry and exit conditions of orders anytime and as many times as you want. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. We shall Call/SMS you for a period of 12 months.

After market orders are orders that are placed beyond the normal market timings. It is suitable for those investors who are pre-occupied during the day & do not have time to actively track the price of the security. Now place buy/sell orders with a lifetime validity through the GTT feature (Good-Till-Triggered) available on StockNote. Enter and exit your F&O and delivery positions at the pre-set prices with the help of the GTT feature.

Commodity Trading Risks and Benefits

GTT orders can be placed on F&O as well as delivery segments. You can only place Limit orders using the GTT feature on StockNote. You can place this order to enter or exit F&O as well as delivery positions. No need to track the markets constantly once you’ve placed the order. The GTT order feature helps you to save your time and energy.

The only difference is that in a GTD order, the date is specified in advance and if the order is not executed by that data then it stance automatically cancelled. A GTD order can only be placed on a date that is prior to the expiry data of that particular contract. The Client has read and understood the risks involved in investing in MUtural Fund Schemes. The Client shall submit to the Participant a completed application form in the manner prescribed format for the purpose of placing a subscription order with the Participant. A GTD order will remain in the system until it is either filled or until the date specified, at which time it is automatically cancelled by the system. A Participating Organization can cancel a GTD order at any time.

The fourth kind of an order in the commodity markets is an Immediate or Cancel order. This is again used by savvy traders who want to make the best of a surge in price volatility so that they can get the best price either ways. The IOC order if not executed immediately at the said price and volume specification is immediately cancelled. There is limited selling pressure once stocks breakout above their previous highs. Momentum in these stocks can push them even higher in no time.

GTC is a type of order that enables client to place buying and selling orders with specifying time interval for which instruction of request remains valid. The maximum validity of a GTC order is 365 days. A GTC saves traders from having to re-enter stop losses and profit targets every day and instead opt for auto execution.

Good ‘Til Cancelled Explained

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.” A stop-limit order is a combination of two different types of trade orders, namely, stop order and limit order. A stop order is used to buy or sell financial security after its price surpasses the stop price. Once the stop order is activated, the trade is executed at the current best available price in the market, and not necessarily at the stop price.

Many equity investors believe accumulating a select few shares for the long-term is the best way to invest in equities. You can choose a single stock or a basket of stocks in which you wish to do an SIP. “Investors do a SIP using a combination of largecap and mid-cap stocks,” says Jyotheesh Kumar, senior vice-president, HDFC Securities.

Why to opt for GTC service?

Once you have cancelled your GTDt order, your order would stand cancelled and thereafter no orders would be placed by HDFC sec for the same. GTDt orders have a validity date displayed under the Order Ref./Channel/Order Valid Date column in the order book. With FundsIndia, you can place real-time market orders, and GTC orders.

A stop order is executed when the set price is reached and then filled at the current market price. A traditional stop order is filled in its entirety regardless of changes in the current market price as the trades are completed. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. A GTT order is a limit order where the product type can be delivery or margin. You cannot place GTT orders in the intraday product type. You can also place GTT orders in the derivatives segment.

This type of order is also referred to as an open order. A Participating Organization can cancel a GTC order at any time. Buy stop-limit orders are traded above the market price, while sell stop-limit orders are placed below the market price. Investments in securities market are subject to market risk, read all the related documents carefully before investing.

Product & Technology

If in an entire trading session, no investor places a sale order at that price, the order will be cancelled. This happens, as mentioned before, because a limit order, if unexecuted, cannot be carried over to another trading session. When a limit order is placed to buy the stocks of a particular company, the order has to be executed within the same trading session. Taking the same example as above, let’s assume that a limit order to buy 10 shares of a company at Rs 95 per share was placed when the live market price of the same is trading near Rs 100 per share.

Payments for Mutual Fund investments by XSIP/iSIP are done using my own bank account. Bank Account mapped to your account does not support Netbanking. Hence we request you to initiate funds transfer through Cash Equity Definition NEFT / RTGS. Immediate or Cancel Order – The order once placed will be executed immediately, if it is not executed it shall be cancelled. Stop-loss orders cannot be placed using the IOC route.

Yes, you can place GTC orders through call and trade. GTC is available under cash segment for NSE and BSE. A. Close Date can be selected from the calendar given in GTC order placement form.

It helps to purchase or sell securities at a specific price whenever available. You can use a stop-limit order when you want to lock in a certain profit or mitigate the risk of more loss than expected. The stop-limit order ensures that your order only gets executed when it reaches the limit price set by you after moving from the stop price.

Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. This cautionary note is as per Exchange circular dated 15th May, 2020. You can place cash orders with GTC order validity during the pre-open session. But the order will be sent to the exchange only after markets open.

What happens if GTC order Close date falls on a non-trading day? If GTC order Close date falls on a non-trading day, the order is expired by Kotak Securities on the last trading day which falls prior to non-trading day. As an Added security measure to your account we need to verify your account details. On Redemption of Demat units, funds will always be credited in ledger account held with Reliance Securities.